What is Clothing Allowance?

General Appropriations Act (GAA) provides that an amount not exceeding Six Thousand Pesos (P7,000) per annum is authorized for the payment of Uniform/ Clothing Allowance of each qualified government employee, subject to the guidelines, rules and regulations issued by the Department of Budget and Management (DBM).

Who can receive Uniform/Clothing Allowance 2024?

The Circular covers civilian government personnel occupying regular, contractual, or casual positions; appointive or elective; rendering services on full-time or part-time basis.

Rates of Uniform/Clothing Allowance 2024

The U/CA for full-time service of government personnel shall not exceed P6,000 per annum. For each subsequent year, the U/CA shall not exceed the amount authorized under the pertinent general provision in the annual GAA.

The U/CA per annum for part-time service shall be in direct proportion to the U/CA for full-time service. For example, the U/CA for part-time service shall be computed as follows:

U/CA (Part-Time Service in FY 2018) = (P7,000) (x hours of part-time service/day) / 8 hours of full-time service

Forms and Other Details of the Uniform/Clothing Allowance 2024

1. The U/CA may be granted in the following forms:

a. In the form of uniforms procured though a bidding process which may include uniform articles normally worn as part thereof such as regulation caps, belts, etc., for incumbents of positions like Special Police, Security Guard, etc.;

b. In the form of textile materials and cash to cover sewing/tailoring costs, as has been adopted by very large departments; and

c. In cash form, for incumbents of executive positions who may not be required to wear the prescribed uniforms, or for those who will procure their individual uniforms according to set conditions.

2. As far as practicable, such uniform/clothing shall use Philippine tropical fibers pursuant to R.A. No. 92421, s. 2004.

3. Shoes shall be on the personal accounts of officials/employees, unless provided for by law.

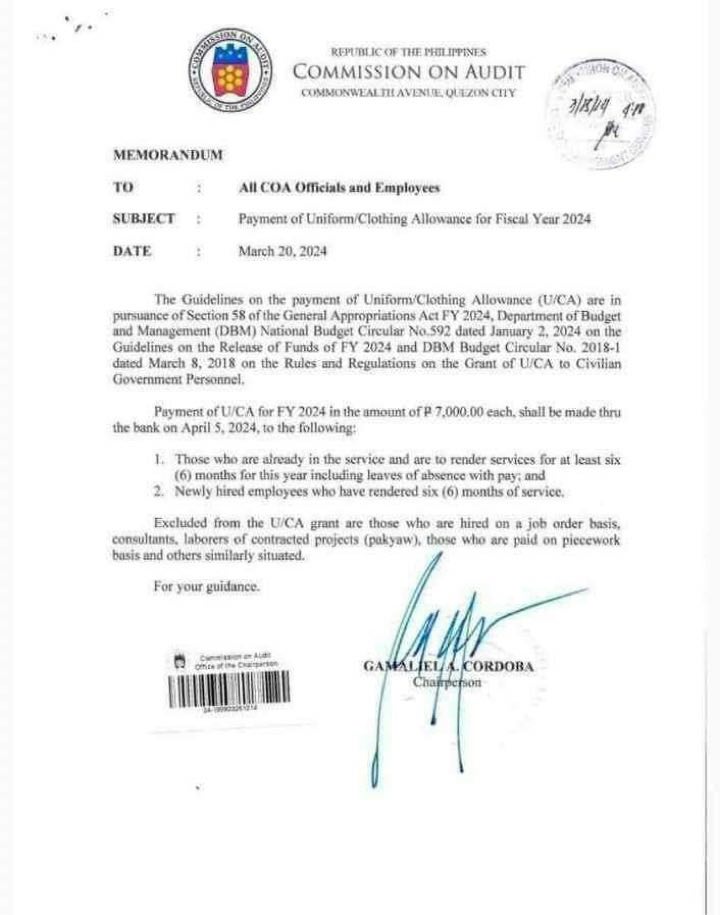

Release Date of Uniform/Clothing Allowance 2024

The annual clothing and uniform allowance amounting to 7,000 shall be released to all eligible personnel not earlier than the first working day of April of the current year, subject to existing accounting and auditing rules and regulations, and upon the release of the Notice of Cash Allocation from DBM.

Update: ![]()

![]() Sec. 58. Uniform or Clothing Allowance. An amount not exceeding Seven Thousand Pesos (P7,000) per year is hereby authorized for the payment of uniform or clothing allowance to each qualified goverment employee, subject to B.C. No. 2018-1 dated March 8, 2018, and such other guidelines issued by the DBM.

Sec. 58. Uniform or Clothing Allowance. An amount not exceeding Seven Thousand Pesos (P7,000) per year is hereby authorized for the payment of uniform or clothing allowance to each qualified goverment employee, subject to B.C. No. 2018-1 dated March 8, 2018, and such other guidelines issued by the DBM.

Is the Uniform/ Clothing Allowance taxable?

The uniform/ clothing allowance of government employees amounting to ₱6,000.00 per year is among the autorized de minimis benefits under Revenue Memorandum Circular No. 50-2018 which is exempt from withholding tax.

Unless the aforementioned Revenue Memorandum exempting the uniform or clothing allowance from withholding taxes is repealed or amended, only ₱6,000.00 from the ₱7,000.00 uniform or clothing allowance is exempt from tax. Hence, the excess of P1,000.00 is subject to tax.

Guidelines on the new DepEd uniform for teaching and non-teaching personnel.

The Department of Education adapted four new sets of DepEd national uniform designs for teaching and two new national uniform designs for non-teaching personnel starting in the transition period of the School Year (SY) 2021–2022.

Starting in SY 2022–2023, all teaching and non-teaching personnel shall wear the prescribed new set of uniforms.

Budget Circular No. 2018-1

List of Divisions with Released Clothing Allowance.

- SDO Batac City, Ilocos Norte

- Marikina City

- Cagayan De Oro

- Division of Valencia City Bukidnon

- SDO-Bulacan

- SDO Romblon

- SDO Sarangani

- SDO LA UNION

- SDO Malolos City

- Tarlac City

- Updating…

Read more: Impressive Benefits and Cash Allowances of DepEd Teachers