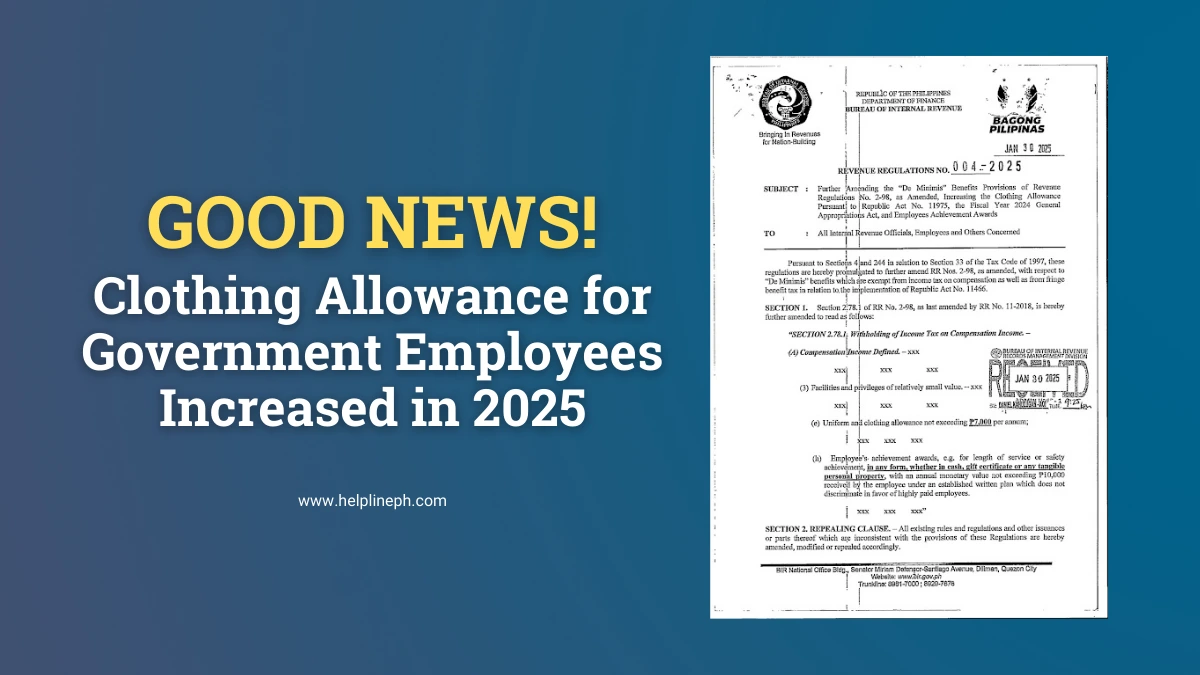

Government employees in the Philippines have something to look forward to this 2025. The Bureau of Internal Revenue (BIR) has released Revenue Regulations No. 004-2025, which increases the annual clothing allowance for government workers to ₱7,000.

This update provides financial relief to employees who rely on this allowance for their work attire. The best part? This allowance is tax-free, meaning employees will receive the full amount without deductions.

What is the Clothing Allowance for Government Employees?

The clothing allowance is an amount given to government employees every year to help them buy uniforms or work-appropriate clothing. This is an important benefit because most government agencies require employees to follow a dress code.

The previous clothing allowance was lower, but with the new regulation, employees will now receive ₱7,000 annually.

Why is This Increase Important?

The cost of clothing and uniforms has gone up over the years due to inflation. Many government employees have requested an increase in their clothing allowance to match rising prices. With this adjustment, employees can better afford quality workwear without using their personal funds.

Tax-Free Benefit Under Republic Act No. 11466

One major highlight of this change is that the clothing allowance is exempt from income tax and fringe benefit tax. This means employees will receive the full ₱7,000 without any deductions.

According to the BIR, this exemption is based on Sections 4 and 244 in relation to Section 33 of the Tax Code of 1997. The law states that “De Minimis” benefits (small additional benefits given to employees) are not taxable. Since the clothing allowance falls under this category, it will not be included in the computation of an employee’s taxable income.

This is a huge advantage for employees, as they do not have to worry about losing part of their allowance due to taxes.

Who is Eligible for the Clothing Allowance?

This benefit applies to all qualified government employees, including:

✅ Public school teachers

✅ Local government employees

✅ National government employees

✅ Workers in government-owned and controlled corporations (GOCCs)

Employees must check with their agency or department for specific guidelines on how and when the allowance will be distributed.

How Government Employees Can Use Their Allowance

The clothing allowance is meant to help employees buy appropriate attire for work. Some common uses include:

👔 Buying office uniforms

👟 Purchasing shoes suitable for work

👜 Getting work-appropriate bags and accessories

👕 Buying casual business wear if required by the agency

While agencies may have specific rules on how the money should be spent, the main goal is to ensure employees look professional while performing their duties.

When Will the Increase Take Effect?

The new clothing allowance amount of ₱7,000 will be applied starting in 2025. Employees should expect further announcements from their respective agencies regarding the exact date of release.

How to Claim the Clothing Allowance

Each government agency follows its own process for distributing allowances. However, the general steps usually include:

1️⃣ Verification of eligibility – The agency confirms if the employee qualifies for the benefit.

2️⃣ Approval of budget – The agency ensures that funds are available.

3️⃣ Disbursement of funds – The clothing allowance is either given in cash or included in the payroll.

4️⃣ Compliance check – Some agencies may require employees to submit proof of purchase.

Employees should check with their HR department or accounting office for specific instructions.

What Employees Should Do Next

✅ Stay updated – Follow announcements from your agency or department regarding the release date.

✅ Plan your purchases – Make sure to use the allowance wisely for work-related clothing.

✅ Ask questions – If you are unsure about the claiming process, contact your HR department.

This increase is a great help for government employees, ensuring they have the proper attire to perform their duties professionally.

Frequently Asked Questions (FAQs)

Who is eligible for the ₱7,000 clothing allowance?

All qualified government employees, including public school teachers, local and national government workers, and employees of government-owned corporations.

Is the clothing allowance taxable?

No, the clothing allowance is tax-free under the “De Minimis” benefits category.

When will the new clothing allowance take effect?

The increase will be effective in 2025, but employees should check with their agencies for the exact release date.

Can I use the allowance for non-work-related clothing?

The clothing allowance is meant for work-appropriate attire. Employees should follow their agency’s guidelines on how to use it.

How can I claim my clothing allowance?

Each agency has its own process, but it generally involves verification, approval, and disbursement. Contact your HR office for details.

Final Thoughts

This increase in the clothing allowance is a positive step in supporting government employees. With the rising cost of workwear, this additional amount ensures employees can dress appropriately without extra financial burden.

Government workers should stay informed and coordinate with their agencies to receive their updated clothing allowance in 2025.