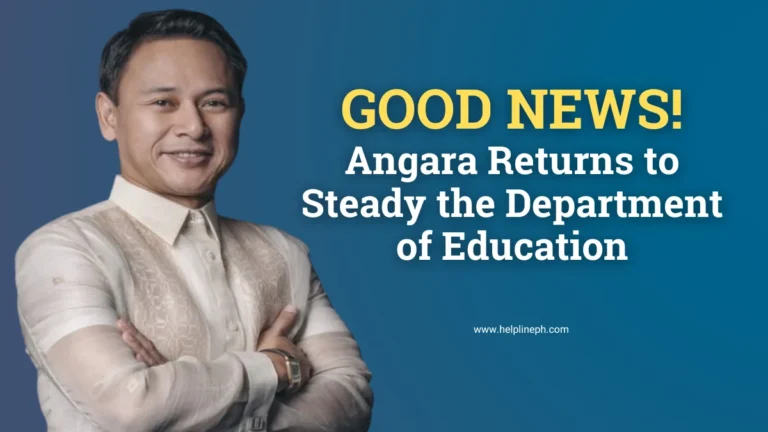

Teachers to Receive Extra ₱1,000 Election Honorarium This Week

This week, teachers will receive an extra ₱1,000 in election service honoraria, as announced by Education Secretary Sonny Angara. Learn how this move supports educators and what to expect next.