Government Services

2 teachers died because of aneurysm, not heatstroke

2 teachers died because of aneurysm, not heatstroke Mr. Leonil Salvilla, who works for the Schools Division Office of Iloilo,

VP Sara should resign as DepEd Sec – Solon

VP Sara should resign as DepEd Sec – Solon A government official from Manila has asked Vice President Sara Duterte

How Filipino Teachers Relax and Stay Productive Over the Weekend

How Filipino Teachers Relax and Stay Productive Over the Weekend Being a teacher in the Philippines can be very challenging.

No need to buy alternate uniform – DepEd

No need to buy alternate uniform The Department of Education (DepEd) has announced that teachers and non-teaching staff do not

DepEd Tops Trust and Performance Ratings in Q1 Survey

DepEd Tops Trust and Performance Ratings in Q1 Survey In the latest survey conducted by OCTA Research, the Department of

VP Sara embraces direct communication with DepEd personnel

VP Sara embraces direct communication with DepEd personnel Vice President and Secretary of the Department of Education (DepEd), Sara Duterte,

End Classes in April for SY 2024-2025: A Proposal for a Shift Back to the Old School Calendar

End Classes in April for SY 2024-2025: A Proposal for a Shift Back to the Old School Calendar The Alliance

List of Places with Class Suspensions for April and May 2024

List of Places with Class Suspensions for April and May 2024 The heat index is a measure that tells us

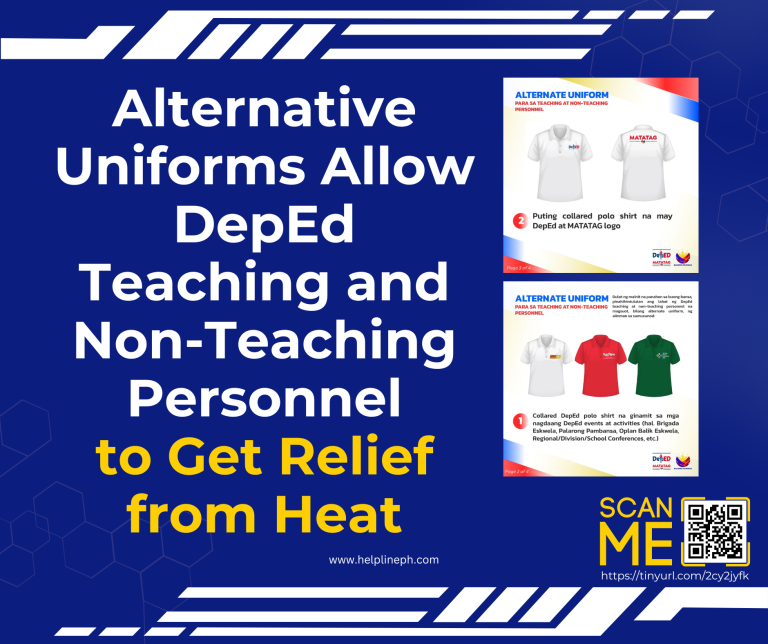

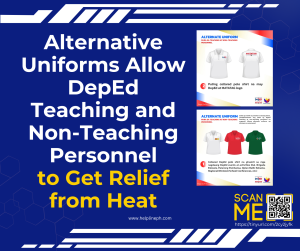

Alternative Uniforms Allow DepEd Teaching and Non-Teaching Personnel to Get Relief from Heat

Alternative Uniforms Allow DepEd Teaching and Non-Teaching Personnel to Get Relief from Heat The Department of Education (DepEd) in the Philippines has announced that due to the ongoing high temperatures

Government Workers to Receive Mid-Year Bonus Starting May 15

Government Workers to Receive Mid-Year Bonus Starting May 15 A document known as the Budget Circular includes specific rules about how government employees can receive a mid-year bonus. Here, we

No Face to Face Nationwide (April 15-16, 2024)

No Face to Face Nationwide (April 15-16, 2024) In order to allow learners to complete pending assignments, projects, and other requirements as the end of school year is fast-approaching, all

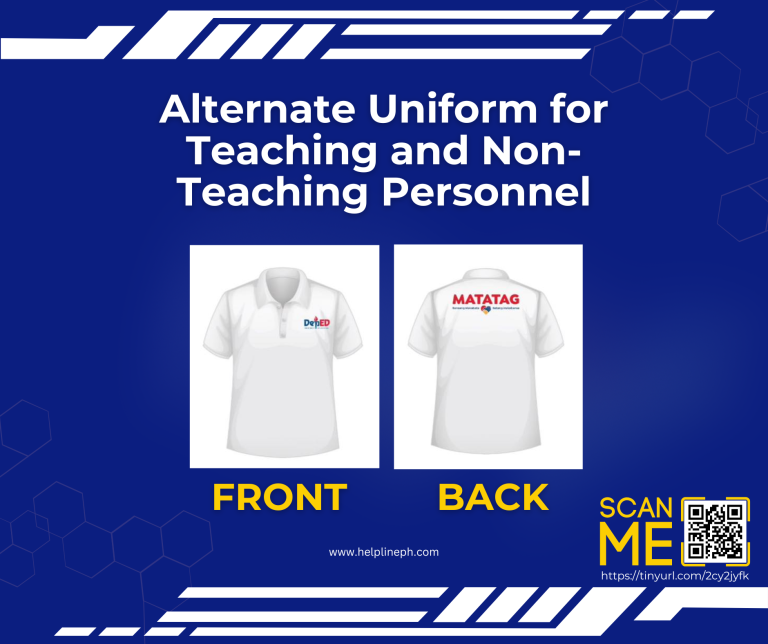

Alternate Uniform for Teaching and Non-Teaching Personnel

Alternate Uniform for Teaching and Non-Teaching Personnel DepEd has issued a memorandum regarding the introduction of alternative uniforms for both teaching and non-teaching personnel. This decision has been made in

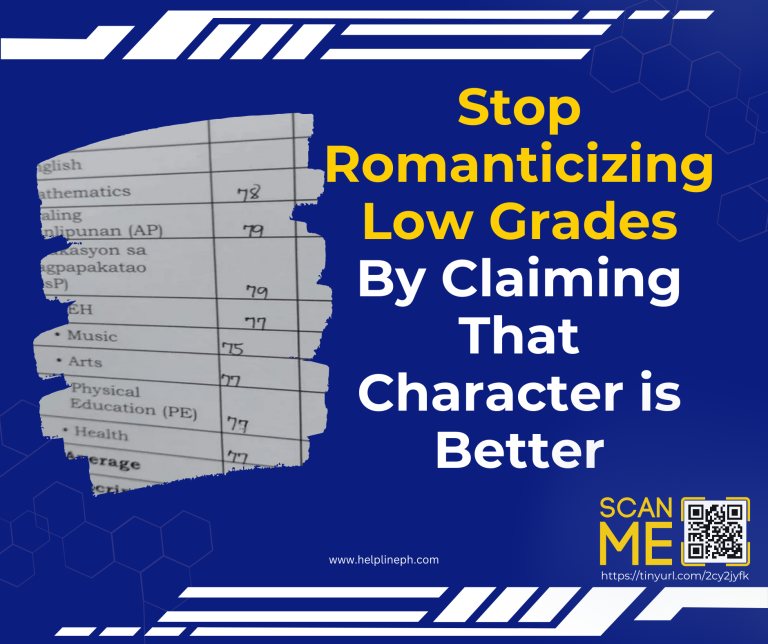

Why Students Should Not Be Forced to Attend Classes in Extreme Heat

Why Students Should Not Be Forced to Attend Classes in Extreme Heat Senator Sherwin Gatchalian voiced concerns over the safety of students attending school amidst the rising temperatures across the

HOW TO ARTICLES

HOW TO ARTICLES

HOW TO ARTICLES

LATEST

2 teachers died because of aneurysm, not heatstroke

2 teachers died because of aneurysm, not heatstroke Mr. Leonil Salvilla, who works for the

VP Sara should resign as DepEd Sec – Solon

VP Sara should resign as DepEd Sec – Solon A government official from Manila has

How Filipino Teachers Relax and Stay Productive Over the Weekend

How Filipino Teachers Relax and Stay Productive Over the Weekend Being a teacher in the

No need to buy alternate uniform – DepEd

No need to buy alternate uniform The Department of Education (DepEd) has announced that teachers

DepEd Tops Trust and Performance Ratings in Q1 Survey

DepEd Tops Trust and Performance Ratings in Q1 Survey In the latest survey conducted by

VP Sara embraces direct communication with DepEd personnel

VP Sara embraces direct communication with DepEd personnel Vice President and Secretary of the Department

2 teachers died because of aneurysm, not heatstroke

2 teachers died because of aneurysm, not heatstroke Mr. Leonil Salvilla, who works for the Schools Division Office of Iloilo, said this. He got this information from the district supervisor

VP Sara should resign as DepEd Sec – Solon

VP Sara should resign as DepEd Sec – Solon A government official from Manila has asked Vice President Sara Duterte to step down from her position as the head of

How Filipino Teachers Relax and Stay Productive Over the Weekend

How Filipino Teachers Relax and Stay Productive Over the Weekend Being a teacher in the Philippines can be very challenging. From Monday to Friday, teachers are busy teaching classes, helping

No need to buy alternate uniform – DepEd

No need to buy alternate uniform The Department of Education (DepEd) has announced that teachers and non-teaching staff do not need to purchase collared shirts as alternate uniforms for the

DepEd Tops Trust and Performance Ratings in Q1 Survey

DepEd Tops Trust and Performance Ratings in Q1 Survey In the latest survey conducted by OCTA Research, the Department of Education (DepEd) has been ranked as the most trusted and

VP Sara embraces direct communication with DepEd personnel

VP Sara embraces direct communication with DepEd personnel Vice President and Secretary of the Department of Education (DepEd), Sara Duterte, has announced a new initiative to strengthen communication within her

End Classes in April for SY 2024-2025: A Proposal for a Shift Back to the Old School Calendar

End Classes in April for SY 2024-2025: A Proposal for a Shift Back to the Old School Calendar The Alliance of Concerned Teachers (ACT) has proposed that ending school classes

List of Places with Class Suspensions for April and May 2024

List of Places with Class Suspensions for April and May 2024 The heat index is a measure that tells us how hot it really feels when the humidity is combined

Alternative Uniforms Allow DepEd Teaching and Non-Teaching Personnel to Get Relief from Heat

Alternative Uniforms Allow DepEd Teaching and Non-Teaching Personnel to Get Relief from Heat The Department of Education (DepEd) in the Philippines has announced that due to the ongoing high temperatures

Government Workers to Receive Mid-Year Bonus Starting May 15

Government Workers to Receive Mid-Year Bonus Starting May 15 A document known as the Budget Circular includes specific rules about how government employees can receive a mid-year bonus. Here, we